HoganTaylor Names New Office Managing Partner in Oklahoma City

January 18, 2024 •HoganTaylor

HoganTaylor LLP Announces 2024 Promotions

January 16, 2024 •HoganTaylor

HoganTaylor Names New Office Managing Partner in Fayetteville

January 11, 2024 •HoganTaylor

HoganTaylor Announces Three New Partners

January 3, 2024 •HoganTaylor

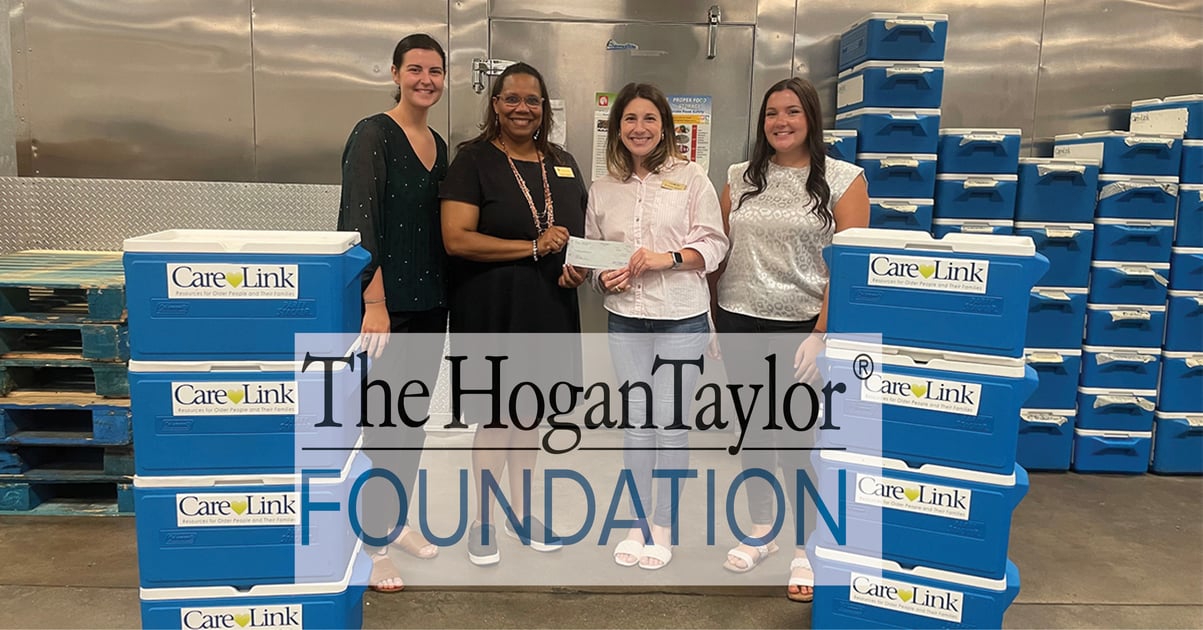

The HoganTaylor Foundation Announces 2023 Grant Recipients

September 27, 2023 •HoganTaylor

HoganTaylor LLP Announces 2023 Mid-Year Promotions

August 1, 2023 •HoganTaylor

Megan Courtney Joins HoganTaylor as Tax Partner

June 6, 2023 •HoganTaylor